By Morris Kiruga, in Nairobi

Kenya’s leading telco, Safaricom, announced Peter Ndegwa

as its new CEO a day after a customer-focused rebrand.

Safaricom announced Ndegwa’s appointment on 24 October.

The managing director of Diageo Continental Europe, he will take over in April

2020 as Safaricom’s third chief executive, following the late Bob Collymore,

who served from 2010 to July 2019.

The announcement marks the end of a two-year search for

a new chief executive. At the heart of the succession debate within the

Safaricom board was the issue of

nationality, as Safaricom’s two CEOs since inception have been

foreigners who eventually took up Kenyan citizenship.

Running Kenya’s most profitable company will be a new

challenge for Ndegwa, a Kenyan citizen who has spent the past 15 years in

the alcoholic beverages industry.

He joined Diageo group subsidiary East African Breweries

in 2004 after an 11-year career in accounting firm PwC and has

been managing director of Diageo Continental Europe since July 2018. He

previously served as CEO for Guinness Nigeria and Guinness Ghana.

Perhaps to show Ndegwa’s suitability and understanding of

the local market, Safaricom chairman Nicholas Nganga pointed out in a profile

sent to newsrooms that the Kenyan “is credited with the development of an

affordable-beer strategy for EABL resulting in the production of new brands

such as Senator beer. Senator beer became one of the most successful

innovations by Diageo that has been featured in the Harvard Business

Review.”

In February, then Safaricom CEO Bob Collymore told The

Africa Report that his successor should be “someone who

understands the financial sector a lot more, if we are to occupy the fintech

space, and someone who is not going to be scared of going into other markets”.

Birthday rebrand

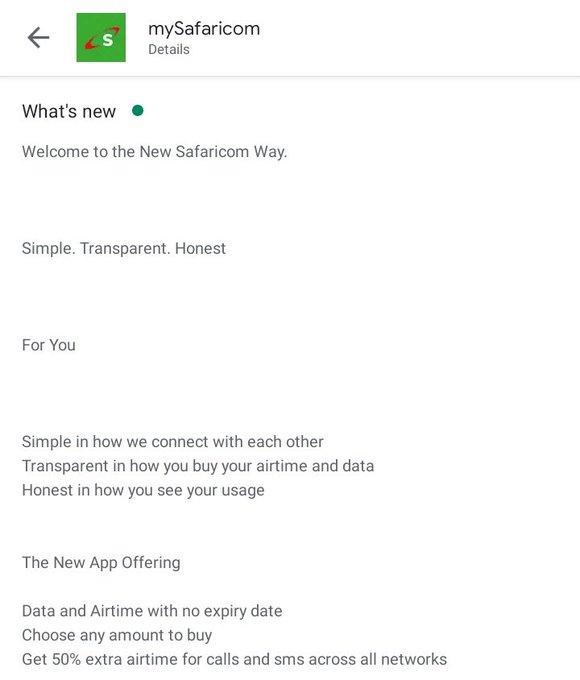

The announcement came a day after Safaricom celebrated

its 19th anniversary on 23 October, and its interim CEO Michael Joseph

announced a rebrand and several consumer-facing changes.

Among the biggest changes was switching its brand promise

from “Twaweza” (“We can”), which was launched just over a year ago, to “For

You”.

Joseph also promised consumers better services and a

better overall experience, announcing that the company would start giving new

subscribers free SIM-cards from 1 November.

For the company’s 30-million-plus existing customers, the

biggest change the telco made was to introduce new voice and data packages

without expiry dates. The expiry of such products has been a constant

source of consumer complaints in telco markets across Africa.

Safaricom’s announcement comes just weeks after a Nairobi

lawyer filed a suit against the expiry of data and voice bundles by the telco

and its competitors.

In mid-October, Ghana’s Ministry of Communications

directed telcos to rollover unused data and voice bundles.

Late last year, South Africa’s telecoms regulator

implemented similar rules, which took effect in March this year, to improve

consumer choices and transparency.

The main issue for consumers is that it deprives them of

services they have already paid for.

“Is technology stuck somewhere such that it’s impossible

to let data last as long as it is not used? Or is this playing well to the

vantage of service providers at the expense of the clientele?” a Malawian

customer recently asked in a letter to the Lusaka Times.

Looks like @SafaricomPLC is front running the questions in why data (an ethereal good) is being treated like a tomato with a finite shelf life, if the notes accompanying the app update are anything to go by.

See Ramah Nyang's other Tweets

Data, voice and messaging still account for the largest

chunk of Safaricom’s revenue, although payment platform M-Pesa’s revenue

share has been growing steadily. In its March 2019 results, for example, the

three services accounted for a total of KSh152bn ($1.47bn) of the company’s

KSh240bn revenue.

The immediate challenge is that the new bundles without

built-in obsolescence will hurt revenue, but the company is banking on

increased consumer confidence to bridge the gap. “I expect over time to see a

corresponding increase in revenue also as we attract customers from other

networks because this is unique to Safaricom,” Joseph said.

Why this matters:

While Ndegwa is still six months away from taking over as

Safaricom CEO, his brief will include revitalising the Safaricom brand in its

home market as well as leading its potential entry into Ethiopia.

In early October, interim CEO Michael Joseph told

the Business Daily that the company was considering buying a

stake in Ethio Telecom, the world’s biggest monopoly, or going for a

greenfield investment as Ethiopia opens up its telecoms and financial services

markets.

Ndegwa will also take over a company facing formidable

competition, as Safaricom’s primary competitors, Airtel and Telkom Kenya, are

working on a merger/joint venture which could be approved before the end of

2019.

No comments:

Post a Comment